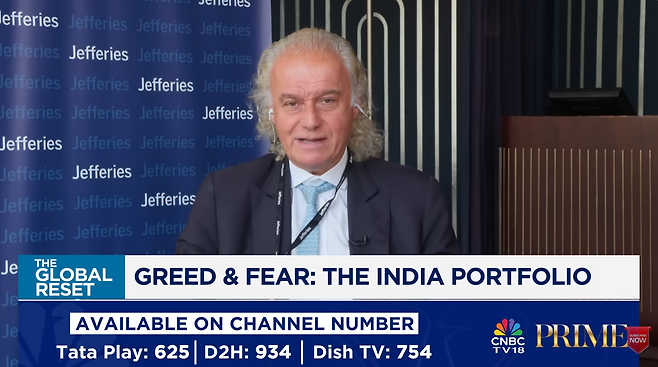

The Quantum Computing Bitcoin threat has transitioned from a theoretical discussion to a legitimate portfolio risk for major institutional investors. On January 17, 2026, Christopher Wood, the Global Head of Equity Strategy at investment bank Jefferies, sent a shockwave through the crypto markets via a client newsletter.

Wood announced that he has liquidated 100% of his Bitcoin holdings—which previously constituted 10% of his portfolio—citing the unexpectedly rapid advancement of quantum technology.

Jefferies Reallocates: Seeking Safety in Gold and Asia

The decision to exit the cryptocurrency market was followed by an immediate defensive reallocation. According to the newsletter, the capital generated from the Bitcoin sale was redistributed as follows:

- 45% into Physical Gold

- 25% into Gold Miners

- 30% into Asian Equities

Wood posits that Cryptographically Relevant Quantum Computers (CRQC) are developing at a velocity that could render public-key encryption vulnerable within days, far sooner than previous consensus estimates of decades.

The Mechanics of the Threat: Public vs. Private Keys

To understand the Quantum Computing Bitcoin threat, one must understand the underlying architecture of Bitcoin transactions. The system relies on a pair of keys:

- Public Key: Acts like an email address. This is shared so others can send you funds.

- Private Key: Acts like the password to that email account. This decrypts access to the funds.

Current transactions require the Public Key to be revealed to the blockchain network. Once a transaction history exists, the Public Key is visible to everyone. Wood’s concern is that advanced quantum computers are becoming uniquely adept at “reverse-engineering” the Private Key solely by analyzing the exposed Public Key.

The 10 Million Bitcoin Exposure Risk

The implications of a quantum breach are staggering. If a wallet has never sent a transaction, its Public Key remains hashed and relatively safe. However, once a wallet sends Bitcoin, the Public Key is revealed.

Estimates suggest that approximately 10 million Bitcoin currently in circulation have exposed Public Keys due to prior transaction histories. This implies that nearly half of the current supply is theoretically vulnerable. If quantum decryption becomes viable before the network upgrades, “Quantum Hackers” could potentially siphon off 20% to 30% of the total Bitcoin supply by 2028.

The Governance Paradox: BIP-360 and Decentralization

Technical solutions to this existential threat already exist. BIP-360 is a proposed Bitcoin Improvement Proposal designed to introduce quantum-resistant encryption standards. However, the problem is not technological; it is political.

Bitcoin’s greatest strength—its decentralized, ownerless nature—becomes its greatest liability in this context. Implementing a hard fork to upgrade the encryption protocol requires broad consensus among:

- Miners

- Node Operators

- Exchanges

- Large Holders (Whales)

Achieving this consensus is notoriously difficult. As Wood highlights, the risk isn’t just that the encryption can be broken, but that the community may not organize quickly enough to patch the vulnerability before the Quantum Computing Bitcoin threat becomes a reality.

Conclusion

The Quantum Computing Bitcoin threat is not a guarantee of immediate collapse, but it represents a significant repricing of risk. While the encryption is not broken today, the timeline for potential vulnerability has shrunk dramatically. For institutional strategists like Christopher Wood, the inability of the decentralized network to guarantee a swift governance response is enough reason to retreat to the historical safety of Gold.

[TMM’s Perspective]

While Christopher Wood’s exit is a bearish signal, we view this as a low-probability, high-impact “tail risk” rather than an immediate certainty. The crypto industry has historically rallied strongest when faced with existential technical threats, forcing rapid innovation. However, for the conservative portion of a portfolio, rotating into Gold as a hedge against both fiat debasement and technological disruption in crypto is a prudent defensive maneuver in 2026.