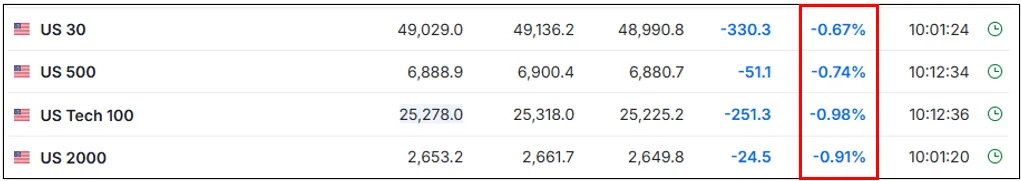

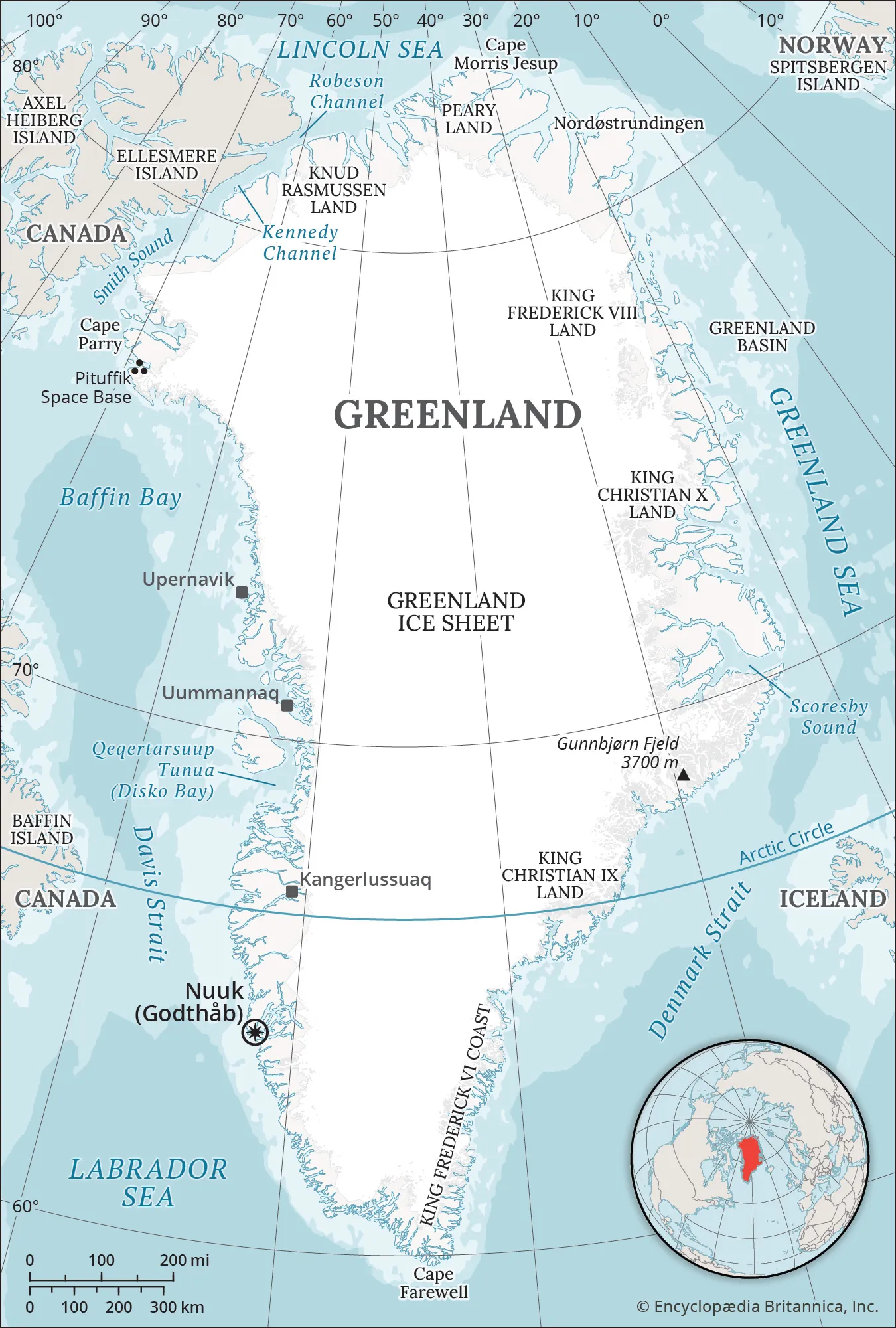

The Greenland Tariff Market Impact is currently the primary source of volatility across global asset classes following a chaotic weekend. With President Trump threatening tariffs if Denmark refuses to negotiate the status of Greenland, we are witnessing immediate red flags in early trading. Ethereum and Bitcoin have retreated approximately 2% from resistance lines, and as shown in the data below, U.S. futures are experiencing notable pre-market declines.

However, despite the noise, experienced investors should recognize this recurring geopolitical pattern not as a crisis, but as a familiar negotiation strategy.

Decoding the Greenland Tariff Market Impact

To understand the current volatility, we must look beyond the headlines. The market is reacting to the uncertainty of Trump’s declaration, but the underlying mechanics suggest this is a “maximum pressure” tactic rather than a prelude to a trade war.

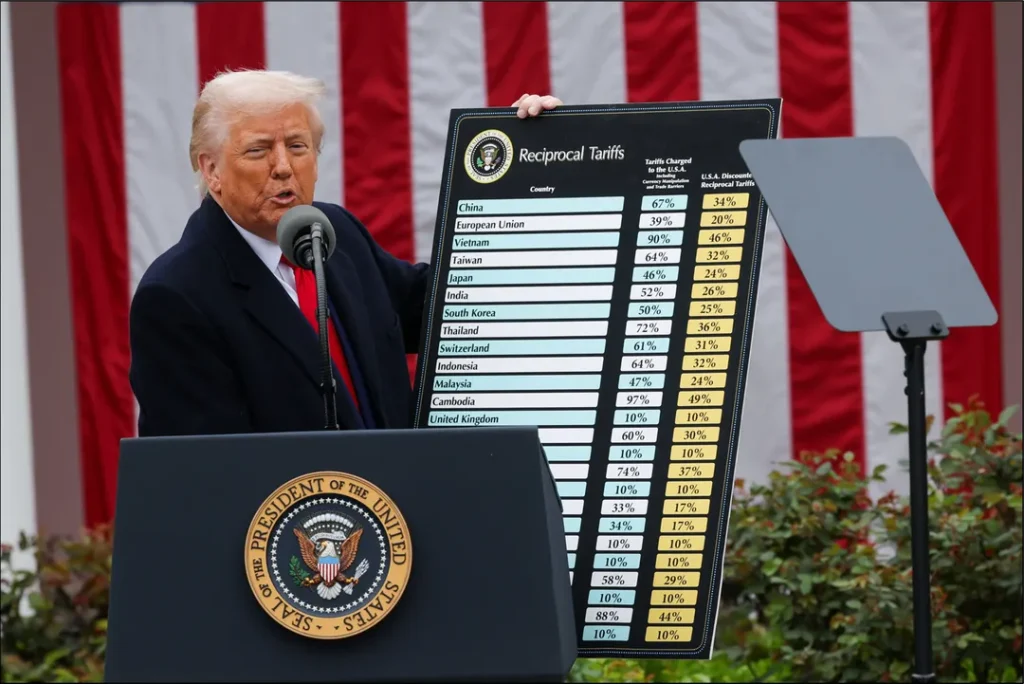

President Trump’s approach to trade has long centered on the concept of “reciprocal tariffs” as a primary negotiating tool.

The pattern is distinct and repetitive:

- Friday/Weekend: High-stakes announcements are made to heighten anxiety while markets are closed.

- The Threat: An extreme demand is set (e.g., “Sell us Greenland or face tariffs”).

- The Goal: Trump aims for a settlement—likely not a full purchase, but a long-term lease or resource rights—to boost approval ratings ahead of the midterm elections.

Consequently, understanding the Greenland Tariff Market Impact requires acknowledging that the administration calculates these moves to minimize actual economic damage while maximizing political leverage. The timing—announced during a market holiday—was likely deliberate to temper initial panic.

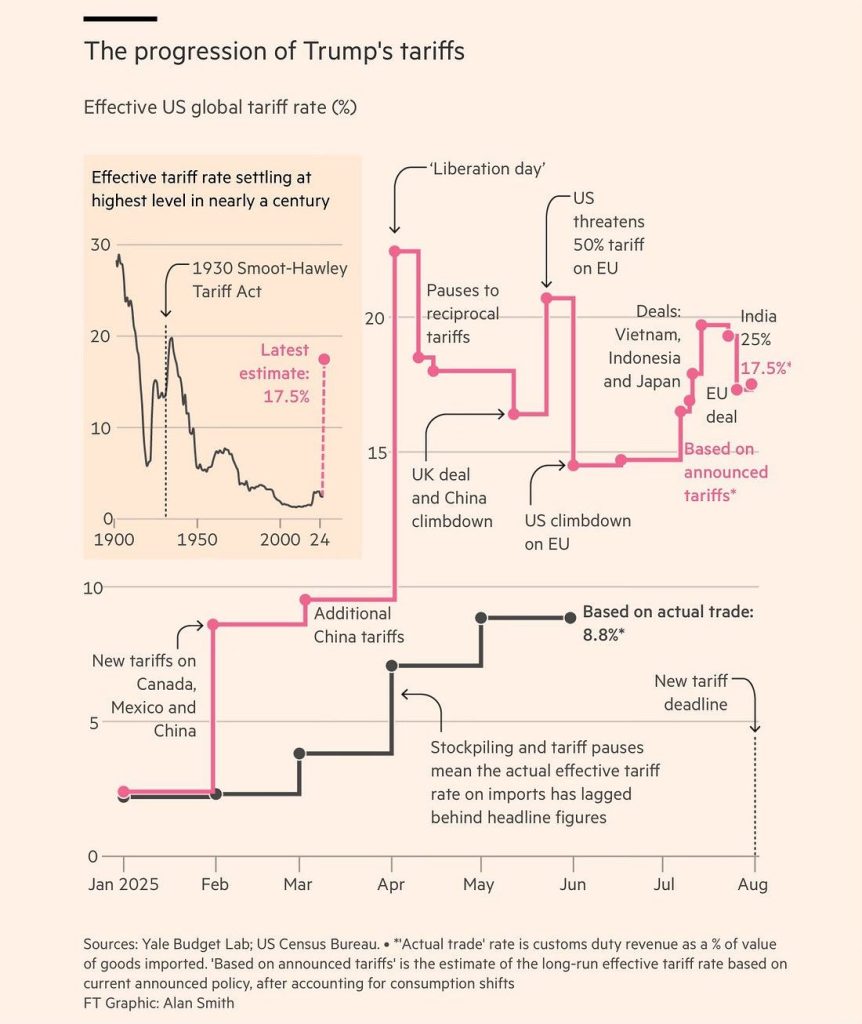

The 2025 Tariff Precedent as a Roadmap

We have seen this playbook before. To predict the outcome of the Greenland dispute, we must review the U.S.-Europe tariff conflict of 2025, which followed a clear pattern of threats followed by deals.

Just as in 2025, when Europe threatened “severe retaliation” over steel tariffs but ultimately capitulated due to economic and security dependence on the U.S., the current situation is likely to follow a similar path. The Greenland Tariff Market Impact will likely resolve with the U.S. demanding 100 and settling for 20—in this case, likely resource rights or strategic basing.

Europe’s Economic Vulnerability and Market Resilience

The probability of a full-scale trade war is low. Europe’s economy is barely recovering from recession, and its leaders know that fighting a tariff war with their primary security and energy partner would be economically devastating. Recent diplomatic meetings between U.S. and Danish officials confirm that negotiations are already underway.

Before this weekend’s news, the S&P 500 had been in a strong upward trend, reaching new highs.

In summary, while the Greenland Tariff Market Impact is causing short-term friction, the structural bullish thesis remains intact. Real economic data indicates that global liquidity is rising, and the real economy is recovering. Based on historical patterns of similar “noise events,” we anticipate a limited correction rather than a crash.

We anticipate a similar maximum correction of -2% to -3% on the S&P 500 from current levels. The market has learned this pattern: high tension leads to a deal, ultimately benefiting the U.S. economy, and investors should not be overly alarmed by the current headlines.

🛡️ How to Protect Your Portfolio?

Structural inflation and trade wars are fatal for “Buy & Hold” investors. If tech stocks drop -30% due to these tariffs, you need an automated exit plan.

Don’t go down with the ship. Use this system to preserve your capital:

👉 Recommended Strategy: [Stop Buying TQQQ Blindly: The “5-218” Strategy to Avoid -90% Crashes]

[TMM’s Perspective] I view the current situation as a classic “buy the dip” opportunity within a noisy bull market. The market has become efficient at pricing in Trump’s negotiation style; we know that “fire and fury” usually ends in a handshake and a trade deal. My strategy remains focused on the undeniable recovery in global liquidity and the bottoming out of the real economy. I am ignoring the headlines and maintaining my positions, as the downside risk here is severely limited to a standard technical correction, as history has repeatedly shown.

1 thought on “Greenland Tariffs: The “Rare Earth” Shock Coming for Tech Stocks (2026)”